Get In and Out of Debt with This Budgeting Hack!

- Jun 28, 2025

- 3 min read

Once I became an adult and on my own, I made the mistake of getting a couple of credit cards, then maxing them out to survive. I had never been taught how to properly use credit. I had the very worst credit but not enough to ever file bankruptcy. I lived very poor for years, struggling to survive in low income housing and a recipient of government services. After I had my son, I was determined to do more to get us out of poverty. Since I had the worst credit (lowest was 410), I lived and survived in a cash based world. If I didn't have cash, then I didn't need it. This lifestyle continued well into my 30s.

Who else used to rent new furniture and appliances by Rent-A-Center or similar businesses, every single time they moved? I never got in bad credit with them, and they sure made money off me!

As I matured, went to school, started my career, I was able to afford some more things, but it wasn't until I reconnected with an old friend that was a mortgage broker that changed my financial course. I never believed I would ever be able to purchase a home of my own and stuck in this scarcity life of living pay check to pay check, renting sub par homes and never advancing in life. My friend asked if he could work with it to see how bad things were with my credit, and this lead me down a new path of fixing my credit, but more importantly how to really budget well. This allowed me to purchase my first home and be virtually debt free! I am not going to focus on how to fix your credit, but let me tell you the budgeting method I used that made my financial health so much easier!-

I call this the 3.5 weekly budgeting method!

It is simple and very effective, but mostly it allows me to be very aware of my income and expenses, and stay on track with them. It also allows me to plan ahead to help me not overspend and even save some money!

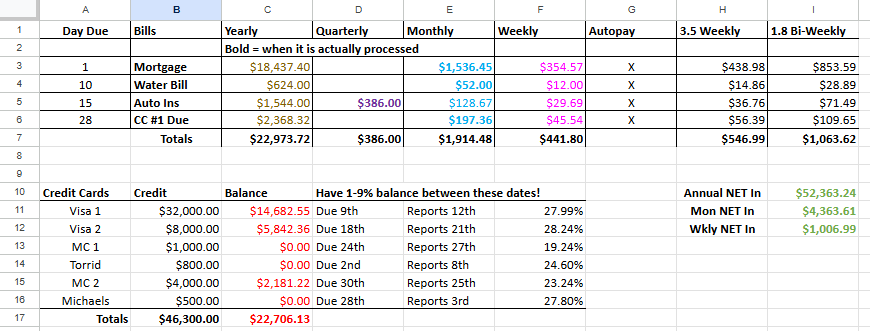

You start with a budget list, I used a spreadsheet for its functions. You list in one column the days of the month so you know when due dates are, then what expenses you have in the line where the due date is, then a break down of Annual-Quarterly-Monthly-Weekly. For monthly or quarterly bills, you want to find the annual amount by multiplying them by 4 or 12. Once you have the annual amount you can break down the weekly amounts by dividing the annual amount by 52 since there are 52 weeks in a year. This is your baseline expenses broken down.

Then the good stuff starts. If you are paid weekly, you divide your monthly amount by 3.5 instead of 4. If you are paid bi-weekly, you divide the monthly amount by 1.8.

Once you have these figures, you go to your bank and set up auto pay for each of these expenses as much as possible. If you are paid weekly, you set it to pay on payday every week. The purpose of this is to have an affordable weekly amount that you can eventually overlap so you never have a late payment. After the first 2 months, you will have a small surplus that will cover the next week and never have a late fee.

I used to have a trash payment of $18 per month, and you better believe I set an autopay bill of $5.15 every week to that company. After the first month and a half, I never had a late fee and eventually at the end of the year, I had a surplus of a few months. After a year, you will notice a bigger surplus for simply paying slightly more than you were supposed to every payment. This comes in really handy if your bill increases, or if something comes up and you have to skip a payment or two, you are still in good shape.

This system is amazing for paying off a vehicle early like I did, saving so much in interest! It is perfect for getting out of credit card debt also. The goal with credit cards is to keep a smaller balance but hit those payments hard to keep that compounding interest down!

I hope this helps, let me know if you would like to read more tips on fixing your credit!

Love you friends! Chelle

Comments